I have made a number of comments about the Eagle Ford Shale (EFS) and possible underreporting by the Texas Railroad Commission (TRRC) of crude plus condensate (C+C) output. See my comments at peak oil.com (fourth comment by dcoyne78 on that page) and at peakoilbarrel.com (see my response to Mike's comment in the comments section.)

The first point is that the TRRC data for Texas(TX) statewide C+C is quite different from the data reported by the US Energy Information Administration (EIA) for TX C+C.

Which data should we believe?

Edit (Jan 16, 2014) see new chart at bottom of post.

Thursday, August 29, 2013

Monday, June 17, 2013

Future Bakken Output and the Average Well Profile

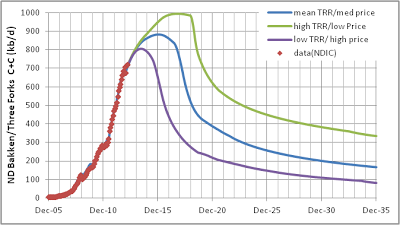

In my June 14 post I discussed future decreases in average well productivity based on a single average well profile to create scenarios which would match the range of technically recoverable resources (TRR) in a recent USGS estimate for the Bakken/ Three Forks.

A recent discussion at the June 15, 2013 Drumbeat at the Oil Drum was very interesting with Rune Likvern providing great insight (as usual) into recent data on Bakken output in North Dakota.

Mr Likvern believes that we may be seeing a decrease in average well productivity because a simulation with wells added at a rate of 125 well per month from Jan 2013 to April 2013 is showing greater output than recent data with 70 fewer wells added (500 for simulation vs 570 actual). A decrease in average well productivity is one possible explanation. An alternative possibility is that the average well profile may be different from the average well profile that Mr. Likvern has chosen.

I have created various well profiles in an attempt to match James Mason's work, Rune Likvern's work, the NDIC typical well, and the actual production data from the NDIC. I have recently created some newer well profiles by using a minimization of the sum of the squared residuals between the model and data over the period from Jan 2010 to April 2013. When no constraints are put on the minimization we get qi=11070, b=0.41, and d=0.078 (I call this model 7).

Friday, June 14, 2013

Future Bakken Crude Oil Output, Oil Price, USGS Estimates, and Decreases in Well Productivity

|

| Summary Chart ND Bakken/Three Forks Scenarios |

The enthusiasm is based on the success in the North Dakota portion of the Bakken/Three Forks play since 2008. The high oil prices over most of the period from 2008 to 2012 has made the high cost oil from North Dakota profitable. Bakken/Three Forks output in North Dakota has expanded from 43 kb/d in Mar 2008 to 719 kb/d in Mar 2013, a 16 fold increase over 5 years. The media believes these increases will continue, but the rate of increase is slowing considerably.

As a cautionary tale, consider Bakken/ Three Forks crude output in Montana (at link click on formation code in left most drop down box and type "bak" in search box, most output is from the Elm Coulee fields (all charts can be clicked to enlarge):

Labels:

Bakken,

Crude Oil,

North Dakota,

Three Forks

Location:

United States

Tuesday, May 21, 2013

Real Oil Prices and the Effect on Future ND Bakken Output

I often read The Oil Drum blog and pointed readers of the Drum Beat to my most recent post here. Rune Likvern asked a question about how future oil prices will effect my scenarios. This is an excellent question because it is often claimed that the recent surge in US oil output may lead to lower oil prices. I expect there is a little too much optimism about future output from the Bakken/Three Forks and Eagle Ford plays, but let's consider two scenarios proposed by Mr. Likvern.

Scenario 1 considers a slower rise in real oil prices than I proposed in my previous post, real oil prices rise to $120/barrel (Jan 2013$) by Jan 2018.

Figure 1 requires some explanation. Break even oil prices rise to the real market oil price by Sept 2016 at $115 per barrel and the wells added ramp down to zero by Dec 2017. It is assumed that real oil prices continue to rise at 3.29 % per year and that the decrease in well productivity slows to zero as no new wells are drilled. Eventually the real oil price rises above the break even price and it is assumed that when the real oil price is 110 % or more of the break even oil price that new wells are added and well productivity then continues to decrease. This cycle repeats 3 times between 2018 and 2037 and explains the bumps in output in 2021-2, 2027-8, and 2033-4.

Scenario 1 considers a slower rise in real oil prices than I proposed in my previous post, real oil prices rise to $120/barrel (Jan 2013$) by Jan 2018.

|

| Figure 1 |

Thursday, May 16, 2013

Updated Well Profile for the North Dakota Bakken and the Effect on future scenarios

A recent post by Rune Likvern at the Oil Drum entitled, Is the Typical NDIC Bakken Tight Oil Well a Sales Pitch? has provided some new information which I will use to update my recent scenario for future Bakken output.

Another post by Mr. Likvern from which I gathered considerable knowledge is entitled Is Shale Oil Production from Bakken Headed for a Run with “The Red Queen”? . In addition a post by Heading Out at the Oil Drum had a number of helpful comments by both Mr Likvern and Webhubbletelescope, the entire thread has comments of interest. There are also a number of posts on the Bakken at The Oil conunDRUM blog(written by Webhubbletelescope) from which I have learned much. I am indebted to both Webhubbletelescope and Mr Likvern for sharing their knowledge.

Friday, April 26, 2013

Bakken Model Suggests 7 Billion barrels total, enough for 1.3 years of US Crude inputs

Note that all images can be enlarged with a mouse click.

Above is one possible scenario for future output from the Bakken which suggests a total cumulative output of 7 billion barrels (Gb) from 1953 to 2073. Current US crude oil inputs to refineries is about 15 million barrels per day (52 week average above 14.9 MMb/d for past 6 months) which is 5.475 Gb per year, the total Bakken output of 7 Gb would supply current refinery inputs for 1.27 years. When we account for the 0.57 Gb of Bakken which has been produced we are left with about 1.2 years of crude inputs at current levels.

The above estimate is based on a presentation from the North Dakota Industrial Commission (NDIC) Oil and Gas Division (see slides 25 to 30). This presentation suggests about 41,000 wells will be drilled in the Bakken at a rate of 1500-3000 wells per year, I chose 2460 wells per year and a total of 42,000 wells drilled by Sept 2028.

Saturday, December 15, 2012

Quick update to tight oil models

I have extended both the Bakken and Eagle Ford Shale models out to 2040. I have assumed no other significant tight oil plays are developed in the US besides these two, this is a somewhat pessimistic assumption, though most other assumptions are relatively optimistic. These may balance out in the long run.

As the Bakken becomes fully drilled up at about 40,000 wells (around the end of 2024) it is assumed that drilling rigs are moved to Texas from North Dakota to work the Eagle Ford play and that there is a ramp up in the number of wells drilled there per month as a result.

In this current scenario, the tight oil output comes close to matching the EIA 2013 outlook (red diamonds in figure below) from 2018 to 2028, but the output is lower both before and after that period.

Bakken:

Eagle Ford:

DC

As the Bakken becomes fully drilled up at about 40,000 wells (around the end of 2024) it is assumed that drilling rigs are moved to Texas from North Dakota to work the Eagle Ford play and that there is a ramp up in the number of wells drilled there per month as a result.

In this current scenario, the tight oil output comes close to matching the EIA 2013 outlook (red diamonds in figure below) from 2018 to 2028, but the output is lower both before and after that period.

Bakken:

Eagle Ford:

US Tight Oil:

|

DC

DC

Subscribe to:

Posts (Atom)