|

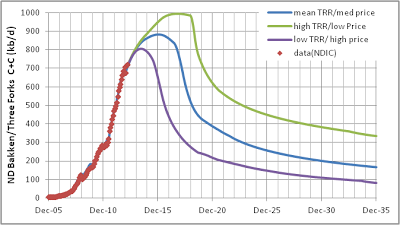

| US Light Tight Oil to 2040 |

- There will be little crude plus condensate (C+C) output from any plays except the Bakken/Three Forks in North Dakota and Montana and the Eagle Ford of Texas.

- The other LTO plays will come to the rescue when the Bakken and Eagle Ford reach their peak and keep LTO near these peak levels to about 2020 with a slow decline in output out to 2040.

Where are these “other LTO plays”? There are a couple of these in Oklahoma and Texas (in the Permian basin, Granite Wash, Mississippian basin), the Appalachian, the Niobrara in Colorado, and others (see slide 17 of the USGS presentation link below). Is it possible for these LTO plays to offset future declines in the Bakken and Eagle Ford? I hope to answer that in this post.