|

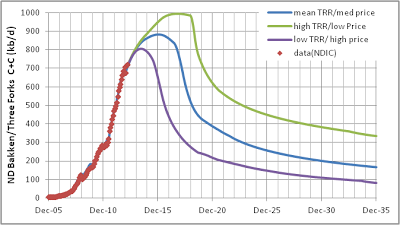

| Summary Chart ND Bakken/Three Forks Scenarios |

The enthusiasm is based on the success in the North Dakota portion of the Bakken/Three Forks play since 2008. The high oil prices over most of the period from 2008 to 2012 has made the high cost oil from North Dakota profitable. Bakken/Three Forks output in North Dakota has expanded from 43 kb/d in Mar 2008 to 719 kb/d in Mar 2013, a 16 fold increase over 5 years. The media believes these increases will continue, but the rate of increase is slowing considerably.

As a cautionary tale, consider Bakken/ Three Forks crude output in Montana (at link click on formation code in left most drop down box and type "bak" in search box, most output is from the Elm Coulee fields (all charts can be clicked to enlarge):

|

Two reports were used to guide the assumptions about future well productivity and oil prices. The first is from the United States Geological Survey (USGS) ( see slides 16-18) and estimates 5.8 billion barrels of oil (BBO) from the North Dakota portion of the Bakken/Three Forks play (F95=3.5 BBO, F5=9 BBO). We use this estimate to create low TRR (technically recoverable resource), mean TRR, and high TRR scenarios where decreases in well productivity are created to match these scenarios. The second report is the most recent Annual Energy Outlook (AEO) 2013 produced by the US Energy Information Administration (EIA) which gives oil price forecasts. We have modified the price forecasts slightly because historically the EIA forecasts for oil price have tended to be too low.

|

| Figure 1- Future Price Scenarios |

|

| Figure 2 |

|

| Figure 3 - Model 3 Avg Well Profile |

|

| Figure 4 |

|

| Figure 5 |

Figure 2 does not account for economics, in order for output to be profitable I determined break even real oil prices in Jan 2013 $ and compare this with real oil prices increasing by 6.68 % per year.

To calculate break even oil prices at the refinery gate, we assume well drilling and fracking costs are $9 million per well, OPEX plus financial costs are $7/barrel, transportation cost is $12/barrel, and royalty and taxes are 25 % of the well head revenue (refinery gate revenue minus transportation costs). Then we use a discount rate of 10 % to find the net present value of the net revenue (revenue-cost) stream from oil output over an assumed 30 year well life. I have calculated the real break even price based on revenue in real dollars (Jan 2013 $), it is assumed real oil prices follow the red dotted line in figure 4, these inflation adjusted prices are used in the break even calculations.

Note that in different scenarios there are different real oil price scenarios, as the oil price scenario changes, the real break even oil price will also change because of both the price itself and the change in the net revenue stream in real dollars.

Mean TRR and Medium Prices

To account for the fact that real oil prices are not likely to reach $2000/barrel and that a 6.68 % rise per year in real oil prices would lead to a reduction in real GDP worldwide, I constructed a more realistic scenario (medium scenario, Figure 1)where real oil prices rise by 3.29 %/year and adjusted the number of wells added per year so that oil production would remain profitable (break even oil prices are less than real oil prices). Prices reach $411/barrel (Jan 2013 $) by 2056 and rise no further (substitutes for oil become cost competitive and demand decreases as a result). Note that the decrease in well productivity is different because it is a function of the number of new wells drilled. If the well productivity decreases by 8 %/year when 2000 wells/year are added, it decreases by 4 % per year decrease if only 1000 wells per year are added. To match output with break even oil prices, fewer new wells were added after the break even oil price was reached, this resulted in a less rapid decrease in well productivity compared with the steady addition of 2000 wells per year.

|

| Figure 6 Mean TRR (5.8 BBO) Med Price |

|

| Figure 7 - Break even oil price, medium scenario |

|

| Figure 8 - Well Productivity Decrease, med scenario |

Low TRR Case and Higher Prices

We will now consider the case where the TRR is at the low end of the USGS estimate for the ND Bakken/Three Forks, which is 3.5 BBO.

If prices can rise to whatever level will cause the oil to be profitable or if we just ignore economics altogether we have the following:

|

| Figure 9 - Low TRR Case |

|

| Figure 10 - Well Productivity Low TRR Case |

The lower oil output would likely lead to higher overall real oil prices so we will consider a higher price path than our Mean TRR/ Medium Price case (high scenario, figure 1). Real oil prices rise by 0.54 % per month (about 6.676 % per year) from Jan 2013 to July 2034. At that point real oil prices have quadrupled from the average 2012 level of $102.5/barrel to $411/barrel. From July 2034 to Dec 2073 it is assumed that real oil prices do not rise above $411/barrel.

|

| Figure 11- Low TRR, High Price Case |

|

| Figure 12 - Break even Oil Prices, Low TRR, High Price |

|

| Figure 13 - Well Productivity - Low TRR, HighPrice |

High TRR, Low Price Case

For those who are opimistic about future US Oil output, we consider the USGS F5 case where the TRR for the ND Bakken/Three Forks is 9 BBO. Well Productivity decreases less rapidly than the mean TRR case, 42500 wells are brought into production and a maximum of 2000 wells/a are added.

|

| Figure 14 - High TRR (9BBO) |

|

| Figure 15 |

Now we assume prices will rise less quickly than in previous cases due to the abundance of oil (low scenario, figure 1). Prices remain at $102.5/ barrel (Jan 2013 $) until Sept 2018 and then rise at about 2 % per year until 2065 (where they reach $269/barrel in real terms), at that point 42,350 wells are producing and no more wells are added.

|

| Figure 16 - High TRR/ Low Price |

|

| Figure 17 - Break even Oil Prices - High TRR/Low Price |

|

| Figure 18 - Well Productivity, High TRR/Low Price |

One final note is that these scenarios are not forecasts, they are possible futures based on a set of assumptions. There are several short comings with these scenarios, technology has been assumed not to progress further, any progress might allow higher output, and the model for average well productivity is based on only two years of data and future average well productivity could be higher or lower than shown in model 3. Finally, I have assumed that well productivity will begin decreasing in March 2013, so far there is not conclusive evidence that the average well brought online in March 2013 is less productive than the average well brought online in Jan 2013, a possible improvement would be to hold average well productivity constant until Dec 2013 and then model well productivity decrease from that point. A subject for a future post.

DC

The ethanol situation is a moving target that bears watching says Shawn Bartholomae, CEO of Prodigy Oil and Gas Company in Irving, Texas. The financial impact on US citizens has not all been good, with the price of corn dramatically driving up the cost of beef, cereals, etc. The battle goes on as engine manufacturers say damage will be done to cars at higher level of ethanol mixed in with gasoline. Now it is even beginning to be a State vs. Federal legal battle. Where will it all end?

ReplyDelete