The recent World Energy Outlook (WEO) published by the International Energy Agency (IEA) predicts that US unconventional output will rise to 5 million barrels per day (Mb/d) in 2020. This increased crude plus condensate (C+C) output will primarily come from tight oil in the Bakken trend in North Dakota and the Eagle Ford trend in Texas.

I decided to update my model of the Bakken based on information learned while attempting to model the Eagle Ford trend in Texas. One thing I discovered in my modelling of the Eagle Ford was that the hyperbolic decline model seems to give a better approximation of the Eagle Ford then the Dispersive Discovery Model that I used in my

previous Bakken Model. For this reason I used a hyperbolic decline model for my updated Bakken Model.

The early wells from 2004 to 2007 have a lower well profile with cumulative output about half that of wells starting production between 2008 and 2012. My previous model had decreases in well productivity of 1 % each month from 2013 to 2019 with new wells starting production in Dec 2019 producing 45 % less cumulative oil than those beginning production in Dec 2012.

I decided that this was too large a decrease in well productivity to be realistic. For the updated model, wells starting production in Feb 2013 produce a cumulative output about 0.5 % less than those which started producing the previous month. Each year the well productivity profile decreases by about 6 % compared to new wells from 1 year earlier. By Dec 2019 new well productivity has decreased by 66 % compared to new wells from Jan 2013. The chart above only shows 3 cumulative output curves with one curve (Jun-16) between the Jan 2008 to Dec 2012 cumulative and the

Dec-2019 cumulative curves. In fact there are 94 curves between the Jan-13 cumulative curve and the Dec-19 cumulative curve one for each month.

The data for C+C output in barrels per day and number of producing wells can be found

here.

In order to forecast future output we assume the average well profile remains unchanged for new wells from Jan 2008 until Jan 2013 and then declines for each month from Feb 2013 to Dec 2019 by 0.5 % as discussed above.

To estimate the number of producing wells in Oct 2012 we use the average of the change in the number of producing wells (delta # of wells) for the previous 7 months which is 162. This number is added to the 4629 wells producing in Sept 2012, thereafter the delta # of wells producing is assumed to increase by 3 each month up to Dec 2013 (162, 165, .... , 201, 204) to a total of 7374 producing wells. Note that between Jan 2010 and Sept 2012 the trend in the increase in delta # of wells was 4 per month. So the increase in the delta # of wells producing of 3 represents a decrease from the previous trend.

This rate of increase of delta # of wells is decreased further to 2 each month from Jan 2014 to Dec 2015 to reach a total # of producing wells of 12870. The rate of increase of the delta # of wells producing decreases again to 1 per month from Jan 2016 to Dec 2017 and producing wells increase to 19218. From Jan 2018 to Dec 2019 the delta # of wells producing stays steady at 276 with the total number of wells reaching 25842.

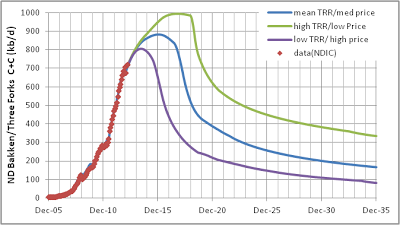

The model by James Mason suggests 40000 wells would be the saturation point for the Bakken with little room for any further increase in producing wells. In the chart below notice the rapid dropoff in output after Dec 2019 when new wells are no longer added. If wells continue to be added at 276 new wells per month then 40000 wells are reached in April 2024, at that point (if Mason's model and my model are both correct) we would see a rapid drop in oil production.

Output peaks at 1.35 Mb/d in early 2019 and then remains on plateau until Dec 2019, this is an example of Rune Likvern's "Red Queen" effect.

I hope to publish a post on the Eagle Ford soon. For some flavor of this, consider this chart:

The Texas RRC database was used to develop the average well profile. Note that data is estimated from a combination of Texas RRC data and EIA data. The Texas data was used to estimate the percentage of all Texas oil coming from the Eagle Ford trend, then this percentage was multiplied by EIA Texas output to estimate Eagle Ford oil output.

Based on these models I think the upper limit to tight oil output from the Bakken and Eagle Ford in 2020 is about 2.7 Mb/d rather than the 5 Mb/d predicted by the IEA. Note that these estimates are quite optimistic and should be thought of as an upper bound to what may be attainable. This is an increase of about 1.6 Mb/d over current US tight oil output of about 1.14 Mb/d. A more realistic scenario might be a doubling of output to 2.3 Mb/d in 2020.

DC